How to Print 1099 in QuickBooks

Quickbooks is the best tool that can help you sort out and prepare your 1099s from the info you have already in your accounts. In preparation for 1099 forms, you need to print all the copies to mail and thereafter finish your Form with the IRS; and send a copy of it to each contractor. Here are the steps that you need to follow in printing 1099 in QuickBooks.

How to print 1099 in Quickbooks

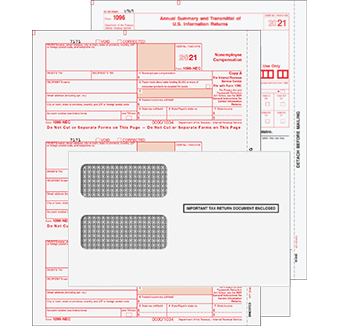

Step 1: Get your 1099 paper

The first step is to acquire your 1099 Kit in January so you can proceed with printing. It would be advantageous for you to send the mail ahead of time to file IRS in every delivery deadline to the contractors. Inuit has an offer of 1099 Forms with size nine 1/2-inch x 11-inch composed of two-window envelopes size five 5/8-inch x 8 3/4-inch.

Step 2: Print your 1099 papers.

Select below on which category does your product belongs.

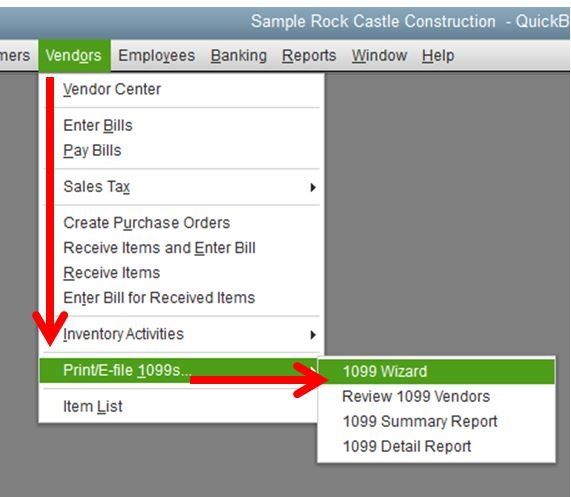

1. Generate in QuickBooks your 1099s

2. Once completed, choose the option "I'll file myself."

3. Select what type of Form that you have for printing

4. Check the alignments of the Form by clicking "Pint sample on blank paper." If you find no problems, click "Yes, it looks good!" If otherwise, click "No, it doesn't line up." To correct the alignment, follow the instructions on the screen to fix, then select "Next."

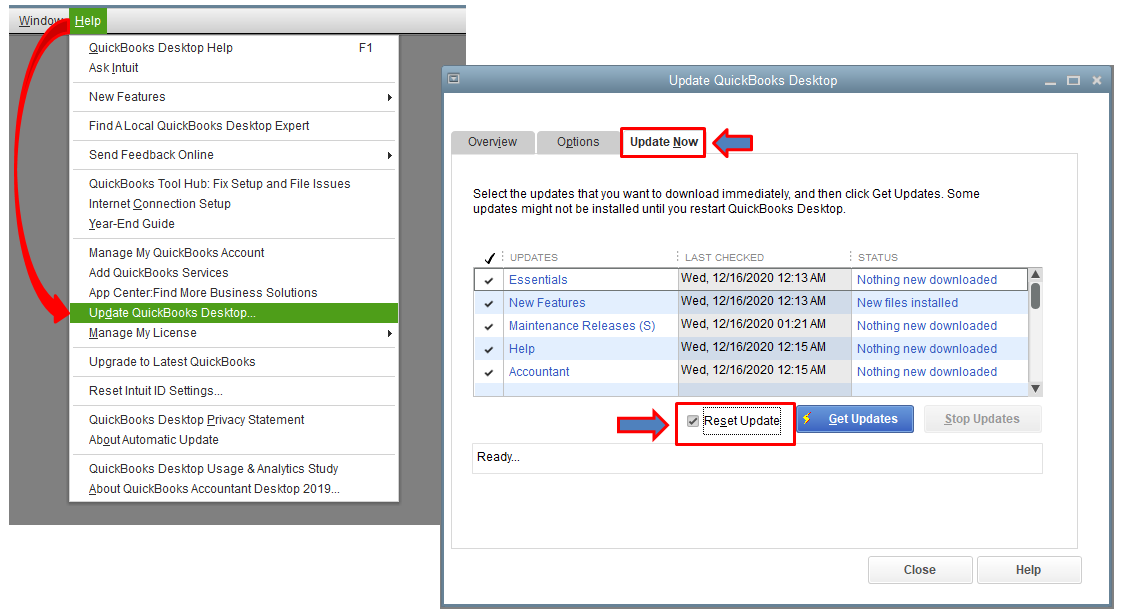

If having problems in printing

There are some instances that your web browser won't be able to print your 1099 forms accurately. Intuit suggests Mozilla Firefox or Google Chrome. If it still doesn't work, try these options.

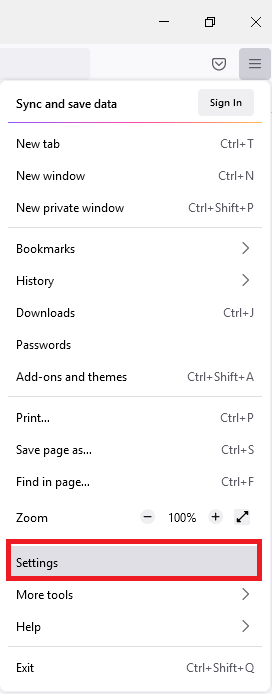

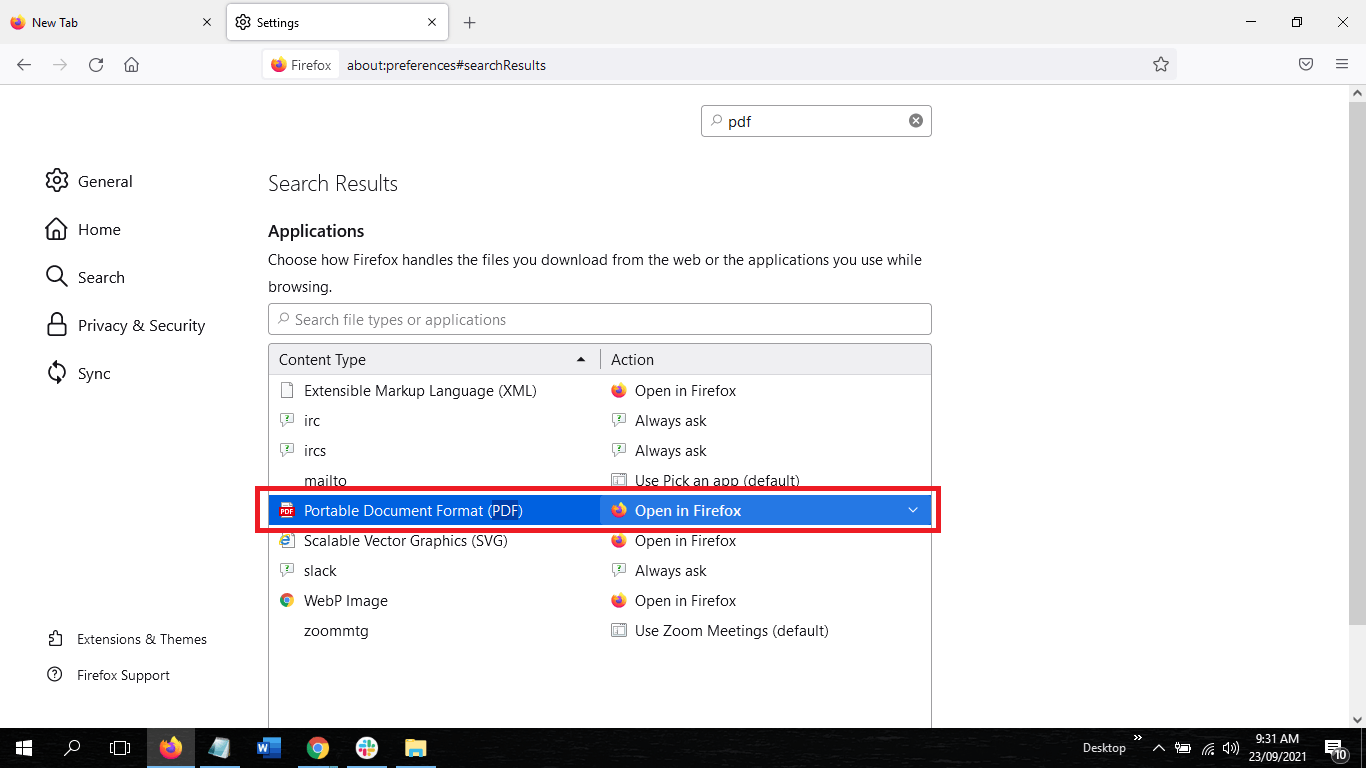

Firefox:

1. Open Firefox, and click the "menu" then "Settings."

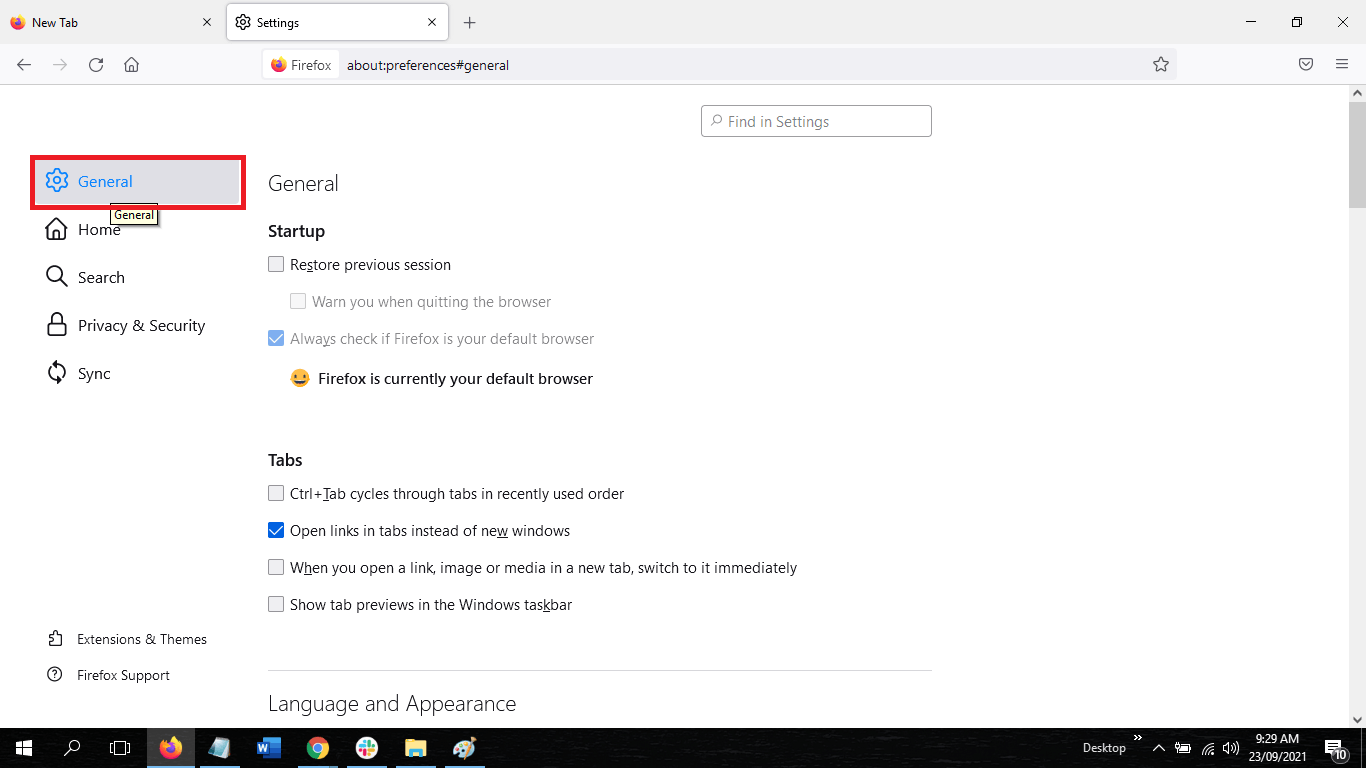

2. Choose "General."

3. Find the Portable Document Format (PDF) in the Applications

4. Open the dropdown and click the PDF viewer that you are using.

5. Reprint your 1099s

When you are downloading it as a PDF and Adobe is supporting the document when it opens:

- Locate file and press right-click

- Select "Open with" and choose "Adobe" on the list

- Reprint your 1099s

Google Chrome

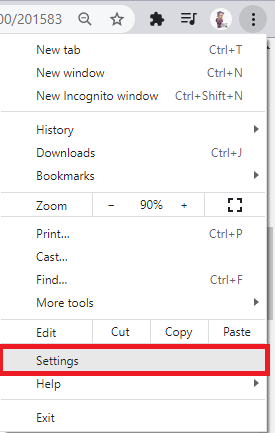

1. Go to Google Chrome and select the three dots on the upper-right corner

2. Click settings

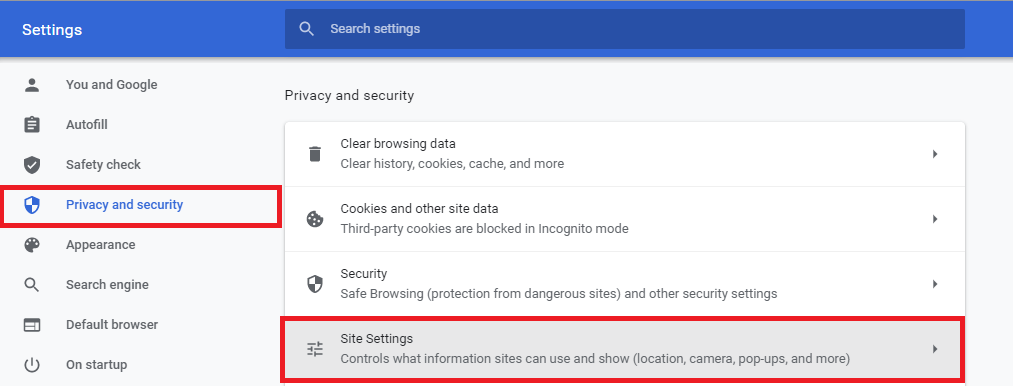

3. Click Privacy and security, then choose Site settings

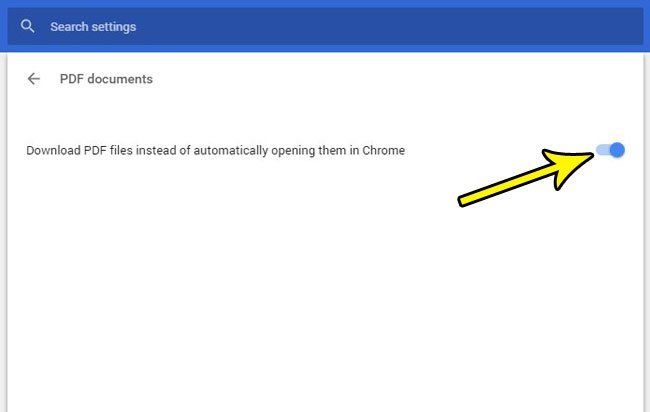

4. Select "Download PDF files instead of automatically opening them in Chrome."

1. Generate in QuickBooks your 1099s

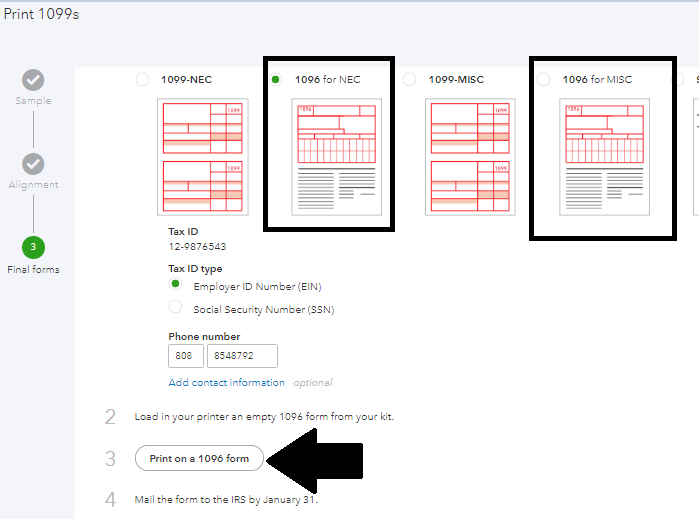

2. In Choosing a filing method window, choose "Print 1099-NEC" or "Print 1099-MISC."

3. Put the date for the forms, then select "OK."

4. Select the vendors that you want to print for 1099s

5. Toggle the "Print 1099" button

6. Setup your printer settings, then click "Print."

1. Generate in QuickBooks your 1099s

2. Go to Google Chrome. After choosing a filing method, click "Print 1099-NECs" or "Print 1099-MISCs."

3. Put the date for the forms, then select "OK."

4. Click the "Print 1099" button, choose "Print 1096s" if you are printing from 1096

5. Setup your printer settings, then click "Print."

On Intuit Online Payroll:

1099s are the kind of tax forms necessary to be filed with the IRS when you compensate contractors via cash, deposit, or check. This convenient feature of Intuit will assist you in the preparation of your 1099s. Follow the basic steps below on how to create your 1099s for payroll purposes.

1. Toggle "Taxes & Forms," then choose 1099. To go back to the 1099 service, you can also use your To-Do item.

2. Choose "Enter Information'' Note: If you used Intuit Online Payroll to pay your contractors in the past year, they would get a checkmark for 1099 if they meet the threshold. Select "Continue."

3. 1099-MISC and 1099-NEC forms are included. Click Edit to make changes for the contractor's information and values on the boxes, or put additional changes in the forms of 1099 for the year 2020. Thus, choose your forms painstakingly.

4. Click "Print for your records" or "Print For Contractors" for those contractors on your records. Again, be mindful of mailing the forms.

5. Put a checkmark on the contractors whom you paid in the past year. Click Continue

6. Put your payment information either a credit card. If it says correct, select "Approve."

7. Submit the final forms.

On Intuit Payroll Full Online Service:

When the year ends, we will prepare 1099 with the IRS Form to distribute to the contractors, including 1099-NEC. This is for the purpose of their Full Online Service on Payroll. Follow the steps to print a copy:

- Find the "Tax Records" tab in Payroll Full Online Service

- Expand the tab by clicking the arrow next to the Form

- Choose the correct form to be printed out.

Step 3: Supply the copies to your contractors

All forms of 1099-MISC and 1099-NEC must be distributed to the contractors approximately by February 1, 2021.

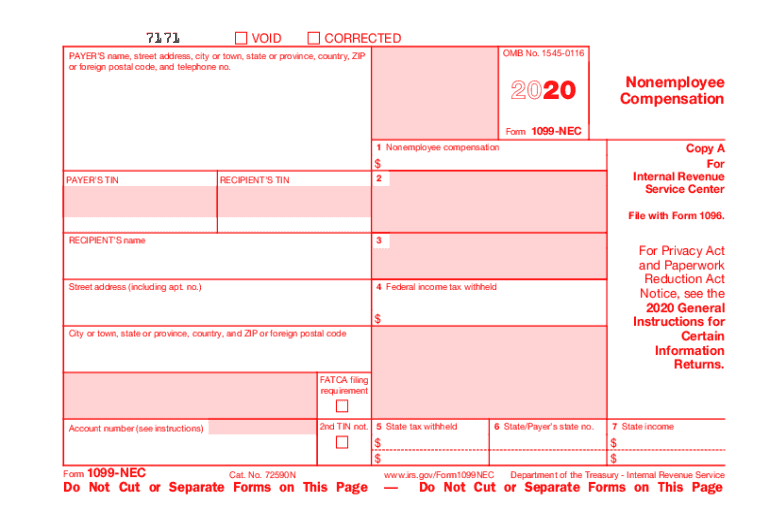

Why do you need to file a 1099-NEC?

Everyone is obliged by U.S. tax law to settle a Form 1099-NEC for someone you have paid exceeding $600 in the previous year. These can be freelancers, vendors, contractors, or any employees that have reported on. The IRS has policies to determine whether a worker is a contractor or team member. Employees will also need a Form 1099-MISC for their taxes to be filed.

Why do you need to file a 1099-MISC?

Everyone is obliged by U.S. tax law to settle a Form 1099-MISC for someone you have paid exceeding $600 in the previous year. Dissimilar to 1099-NEC, the payments in 1099-MISC are constituted towards attorneys, vendors, and those who do not belong to the proper contractors.

A business uses these forms to report team member and non-team member compensations. If a business deliberately chooses not to issue Form 1099-NEC, the sanction will be from $50 to $270 in each Form, contingent on how long the deadline passed the business issues it.

These are only for federal 1099-NEC and 1099-MISC E-file services. If you need more information about the states that require filing, you may contact your state to obtain more information on how to file.

Related Articles